UK Employment Law – 2024 in Review

As 2024 draws to a close, it's a good time to reflect on the year’s most significant changes in employment law. With new rules and new rights, there have been important updates which both employers and employees need to know about. In this post, we will look back at the highlights, giving you a quick refresher on key points for staying compliant and informed.

Flexible Working

In April, the right to request flexible working became a day-one right for all employees. Other updates included: employers being required to consult with employees before rejecting flexible working requests; the deadline for resolving a flexible working application has been updated to two months; and employees now have the right to make two flexible working requests in a year. Acas issued a revised Code of Practice with new guidance reflecting these changes.

Carer’s Leave

Employees have a new right to take up to one week of unpaid carer’s leave every 12 months to provide or arrange for care for a dependant with a long-term care need. This leave can be taken in single or half days.

Paternity Leave

New regulations have given employees the option to take either a one-week or two-week single period of leave, or two non-consecutive periods of leave of one week each. Paternity Leave can now be taken anytime within 52 weeks of the birth. Employees do not have to confirm exact dates until 28 days before the period of Paternity Leave is due to start.

Enhanced Redundancy Protections

Enhanced redundancy protections have been extended for employees taking Maternity Leave, Adoption Leave, and more than six continuous weeks of Shared Parental Leave.

Holiday Pay

New rules on calculating holiday entitlement and an option to pay rolled-up holiday pay came into force for holiday years starting from 1st April 2024. These changes apply to part-year workers and irregular hours workers.

Allocation of tips

New rules have been introduced for tips, deductions, and record-keeping. The requirements are explained in the Employment (Allocation of Tips) Act 2023 and the Code of Practice on Fair and Transparent Distribution of Tips.

TUPE consultation

Some TUPE consultation requirements, relating to employee representatives, have changed for transfers taking place on or after 1st July 2024.

Dismissal and Re-engagement

A Code of Practice on Dismissal and Re-engagement came into force, containing guidance on dismissal and re-engagement (‘fire and re-hire’) practices.

Sexual Harassment

A new legal duty was introduced for employers to take reasonable steps to prevent sexual harassment at work. To support understanding of this new responsibility, the Equality and Human Rights Commission (EHRC) published updated guidance for employers.

Conclusion

It has been an extremely significant year for employment law. To support clients as they navigate these changes, Bright Contracts provides a wide variety of resources which can be tailored to specific needs, including template policies and supporting documents.

Visit our website or talk to a member of our team to find out more about the help we can offer you.

Government Changes

The government has published a paper? which announces that, amongst other things, it will consult on proposals

- to remove EU-derived obligations to keep records of working time.

- to simplify calculating holiday pay.

- to allow businesses to inform and consult the workforce directly about TUPE transfers if they don't have representatives in place, where the employee has fewer than 50 employees and the transfer affects fewer than 10 of them.

The announcement comes at the same time as the government is abandoning its proposed default repeal of all retained EU law in favour of a more limited repeal.

Working time records

The government intends to consult on working time reporting and other administrative obligations under the Working Time Regulations (WTR) 1998. It believes that the current rules place unfair burdens on businesses.

These proposals would include removing retained EU case law which requires employers to record daily working hours, including overtime, worked by employees. This case was decided under the EU Charter of Fundamental Rights and the Working Time Directive. Currently, the UK's Working Time Regulations require only that employers keep and maintain "adequate" records to demonstrate that they are complying with rules on maximum working hours and protections for night workers.

Simplifying calculation of statutory holiday pay

The government proposes to simplify statutory holiday pay calculation, subject to consultation. It identifies two particular measures.

The first is to allow rolled-up holiday pay. Paying holiday pay in this way is a fairly common feature for zero-hours workers who, due to the nature of their working patterns, sometimes don't designate days specifically as annual leave. Rolled-up holiday pay was held to be unlawful several years ago, but amounts clearly identified and paid as such could be offset against any potential liabilities. This has meant that many organisations have continued to use rolled-up holiday pay, due to its administrative convenience, and the lack of a practical alternative.

The second identified measure is to merge the two types of statutory holiday entitlement. A worker's overall statutory entitlement is to 5.6 weeks of leave (28 days for a full-time worker). Four weeks of that entitlement comes from the EU Working Time Directive. The additional 1.6 weeks was granted as a purely UK entitlement. Different rules have built up over time relating to how to calculate statutory holiday pay for the two types of leave, as well as in relation to the right (or lack thereof) to carry leave over to the next holiday year. The paper is silent on which set of rules would be retained. It remains to be seen whether the government will identify any other measures for simplifying holiday pay.

Relaxing TUPE consultation requirements for small businesses

The government will consult on allowing small businesses (employing fewer than 50 people with the TUPE transfer affecting less than 10 employees) to consult directly with affected employees. Currently, unless the employer falls within the scope of a micro-business, they must consult with employee representatives on the TUPE transfer.

Limiting post termination non-compete restrictions to three months

The government is planning to legislate, when parliamentary time allows, to limit the length of post termination non-compete clauses in the employment context to three months. The government does not believe that this will affect an employer’s ability to use paid notice periods, gardening leave or other post-termination restrictions such as non-solicitation clauses. Back in 2020, the government ran a consultation on measures to reform post-termination restrictions in contracts of employment. The consultation closed on 26 February 2021 but the government has not published its response. It is unclear whether the current proposal is intended to take over?the earlier consultation.

Retained EU Law (Revocation and Reform) Bill (REUL Bill)

The government's much championed REUL Bill would have seen all EU-derived subordinate legislation effectively abolished by the end of this year by default, unless it was specifically retained. The number of affected pieces of legislation was estimated to be in the region of 4,000. The Bill allowed the government to extend, exempt or keep affected legislation, but the default position was that it would disappear from the UK statute book.

The government has now acknowledged the widespread criticism of this sunset mechanism and will replace it with a mechanism whereby only expressly listed legislation will be revoked.

It remains to be seen whether any items of employment legislation will make it onto the list of rules to be revoked. However, the government's announcements on TUPE consultation and working time rules suggest that TUPE and the WTR 1998 will be retained.

Aside from the scrapping of the sunset mechanism, the REUL Bill could still be significant for employment law in other ways. The Bill will do away with any remnants of the old principle of the supremacy of EU law as well as "general principles of EU law". In addition, the Bill effectively seeks to encourage UK courts and tribunals to stop and really think whether they should continue to follow any European Court of Justice (ECJ) case law, or domestic case law that applied ECJ case law. One area of employment law that has seen frequent ECJ interventions is the entitlement to paid annual leave.

How the pandemic affected Gender Pay Gap Reporting

Measurement is vital to understanding how much of a problem the Gender Pay Gap is. The World Economic Forum (WEF) Global Gender Gap 2021 report found that the impact of the pandemic has pushed back the gap’s likely date of extinction from just under 100 years to 136 years’ time.

The pandemic and the many business decisions it created fell on women disproportionately. Working mothers were more likely to have their working hours reduced, be furloughed, or lose their jobs than their male colleagues.

The UK Government introduced regulations to improve the level of scrutiny of the gender pay gap. All businesses with 250 or more employees had to publish their gender pay gap. This began in 2018 and there quickly emerged a consistent pattern of gender pay inequality amongst millions of employees, within organisations and across many sectors. Not only did the pandemic damage the job and pay prospects for women but also the progress made in this form of reporting.

Just two weeks before the April 2020 deadline for private sector businesses to publish their April 2019 gender pay gap statistics, the Government announced that due to the pandemic there would be no mandatory requirement to report gender pay gap data in that year.

Despite the negative impacts of the pandemic on an employer's gender pay reporting, businesses should see this as an opportunity to work on effective strategies to reduce the gender pay gap.

Related Articles:

Gender pay gap reporting begins

The Budget 2021: NLW & NMW

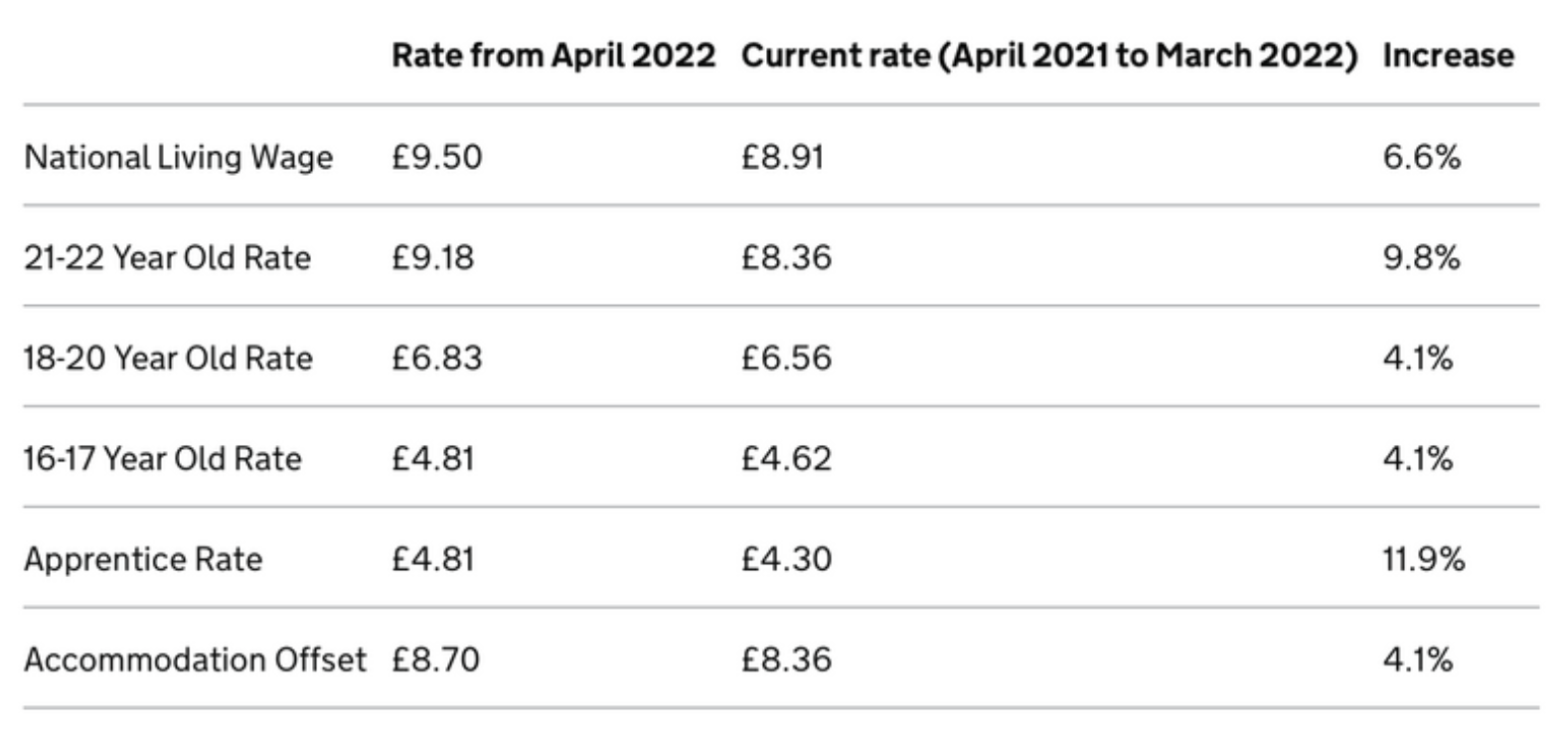

The Chancellor of the Exchequer announced new National Living Wage (NLW) and National Minimum Wage (NMW) details in line with those recommended by The Low Pay Commission (LPC) and these new rates will take effect from 1st April 2022.

The National Living Wage is for those aged 23 and over and the National Minimum Wage is for those of at least school leaving age.

The National Living Wage, the statutory minimum for workers aged 23 and over, will increase by 6.6% to £9.50 per hour.

An employee's age and if they are an apprentice will determine the rate they will receive. These rates can be viewed below:

The Buzz About Carer's Leave

This month the Government confirmed that it will introduce a 'day one' right to statutory carer’s leave. The new entitlement to statutory carer’s leave will:

1. be available to the employee irrespective of how long they have worked for their employer (a day one right);

2. rely on the carer’s relationship with the person being cared for – a spouse, civil partner, child, parent, a person who lives in the same household as the employee or a person who reasonably relies on the employee for care; and

3. depend on the person being cared for having a long-term care need. This would be defined as a long-term illness or injury (physical or mental), a disability as defined under the Equality Act 2010, or issues related to old age. There would be limited exemptions from the requirement for long-term care, for example in the case of terminal illness.

What can the leave be used for?

Personal support, helping with official or financial matters, or accompanying someone to medical and other appointments.

How can the leave be taken?

Either as a single block of one week, or more flexibly in individual days.

How are employee's to notify their employer?

The notice requirement will be in line with that of annual leave, the employee must give notice that is twice the length of time being requested as leave, plus one day in order to enable employers to manage and plan for absences. Employers will be able to postpone, but not deny, the leave request for carer’s leave on grounds that the employer considers that the operation of their business would be unduly disrupted. Employers will be required to give a counter-notice if postponing the request to take Carer’s Leave.

Is there protections for those undertaking carer's leave?

Those taking carer's leave will be protected from suffering a detriment for having done so, and dismissals for reasons connected with exercising the right to carer's leave will be automatically unfair.

When will carer's leave be introduced?

According to gov.uk this right will be introduced into legislation when Parliamentary time allows. In the meantime employers should start to prepare a written policy to introduce this new requirement once introduced.

Related Articles:

- Care Home Workers & Mandatory Vaccinations: The New Regulations

Statutory Sick Pay (SSP) & Isolation

The government has decided to bring the Coronavirus Statutory Sick Pay Rebate Scheme (SSPRS) to an end on the 30th of September 2021. This means that, from the 1st of October 2021, small employers who are currently eligible under the Scheme will no longer be able to claim back statutory sick pay (SSP) for employees unable to work due to COVID-19. Alternatively the employer will have to cover the full cost of SSP which is currently £96.35 a week.

Prior to the COVID-19 pandemic, employers covered the full cost of up to 28 weeks’ SSP for their employees who met the relevant SSP criteria. By law, employers must pay SSP to employees and workers when they meet eligibility conditions.

The scheme only allows you to recover up to two weeks' SSP per employee and is payable from the first qualifying day the employee is off work as the usual rules about 'waiting days' don't apply.

Employees could be entitled to receive SSP if they are self-isolating for any of the following reasons:

- They have tested positive for covid-19

- They have been notified by the NHS or public health authorities that they are a close contact but of course since the 16th of August fully vaccinated close contacts do not need to isolate.

- They have been advised by their doctor or healthcare professional to self-isolate before going into hospital for surgery.

It is important to note that employees are not entitled to Statutory Sick Pay if they're in self-isolation or quarantine after traveling abroad and they cannot work from home.

Record Keeping

Employers need to keep records of SSP if they have paid an employee who was off work because of COVID-19 if the employer wants to reclaim it. They'll need to keep the following records for 3 years after the end of the tax year they paid SSP:

- the dates the employee was off sick

- which of those dates were qualifying days

- the reason they said they were off work

- the employee’s National Insurance number

Employers do not need to keep records of SSP paid to employees who are off sick for another reason. Employers can choose how to keep records of their employees’ sickness absence. The HMRC may need to see these records if there’s a dispute over payment of SSP.

Related Articles:

- Redundancy in the UK: A Guide to Avoiding Unfair Selection

What lies ahead for employers in 2018?

2018 looks set to be another busy year. We take a look at some of what’s coming down the pipeline.

April 2018 - Gender Pay Reporting

Private and voluntary sector employers in England, Wales and Scotland with at least 250 employees will be required to publish information about the differences in pay between men and women in their workforce, based on a pay bill ‘snapshot’ date of 5 April 2017, under the Equality Act 2010 (Gender Pay Gap Information) Regulations 2017. The first reports must be published by 4 April 2018.

Legislation in Northern Ireland mirror the above, except they also include fines of up to £5,000 for non-compliance, and a requirement to report on ethnicity and disability pay gaps, as well as gender.

April 2018: Termination Payments

The government plans to make changes to the taxation of termination payments from April 2018. The proposals include:

• removing the distinction between contractual and non-contractual PILONs (payments in lieu of notice) so that all PILONs are taxable and subject to Class 1 NICs]

• ensuring that the first £30,000 of a termination payment remains exempt from income tax and that any payment paid to any employee that relates solely to the termination of the employment continues to have an unlimited employee NICs exemption

• aligning the rules for income tax and employer NICs so that employer NICs will be payable on payments above £30,000 (which are currently only subject to income tax)

A government consultation on the issue closed in October 2016.

April 2018 – Restricting Employment Allowance for Illegal Workers

The government plans to introduce a further deterrent to the employment of illegal workers. From April 2018, employers will not be able to claim the Employment Allowance for one year if they have:

• hired an illegal worker

• been penalised by the Home Office

• exhausted all appeal rights against that penalty.

A consultation containing draft regulations closed in January 2017.

25 May 2018 – General Data Protection Regulations

The much anticipated General Data Protection Regulation will come into force from 25th May 2018. For those who haven’t already started preparing, now is the time. The GDPR will apply to ALL companies and sole traders that process personal data, the definition of personal data is broad and can include anything from a name, an email address or an IP address.

With possible fines of €20 million or 4% of annual turnover – which ever is higher, businesses need to sit up and take heed.

For further information of GDPR sign up to our employers webinar here or read our blog here.

To book a free online demo of Bright Contracts click here

To download your free trial of Bright Contracts click here

To subscribe to our newsletter click here

Government have launched Employment Tribunal fee refund scheme

Following the ruling in July this year which saw the Supreme Court rule employment tribunal fees as unlawful, the Government is now ready to start repaying the thousands of people that were charged.

The ruling, which was heralded as possibly the biggest employment law decision ever in the UK, saw the Supreme Court unanimously ruling that the Government was acting unlawfully when they introduced the fees back in 2013. Fees of up to £1,200 were introduced resulting in a dramatic fall from 5,847 employment tribunal cases the year before the fees were introduced, to 1,740 the following year.

The first steps

The first stage of the refund process will see up to around 1,000 people contacted individually and invited to complete their forms before the full scheme is opened up in the coming weeks. The Government is also working with Trade Unions who have supported large multiple claims, potentially involving hundreds of claimants.

People who were ordered by the Tribunal to reimburse their opponent their fee and who can show that they have paid it are also eligible to apply for a refund under the scheme.

Successful applicants to the scheme will be refunded their full fee and will also be paid interest of 0.5% calculated from the date of the payment right up to the date of the refund.

The opening phase of the refund scheme will last for around 4 weeks. Further details of the scheme will be made available once the scheme is rolled out fully.

For further details please see gov.uk

To book a free online demo of Bright Contracts click here

To download your free Bright Contracts trial click here

National Work Life Week – 2nd to 6th October

Organised by Working Families in their yearly campaign National Work Life week will run from 2nd to 6th October 2017. This annual campaign is to encourage both employers and employees to discuss work life balance and talk about wellbeing in the workplace.

On Wednesday 4th October “Go Home on Time Day” takes place, which encourages all employees to leave work on time and have the opportunity to contemplate achieving a work and home life balance. Research carried out by Working Families shows a large number of employees working more than their contracted hours every week. Working Families are encouraging employers to advise their employees to leave work at the correct time on “Go Home on Time Day”.

A toolkit can be downloaded by employers for ways on how they can take part in the National Work Life Week. It can be downloaded by clicking here. This gives employers an opportunity to display to employees and stakeholders that their organisation aims and encourages a healthy work life/home life balance for employees.

The National Work Life Conference for employers takes place in London on 2nd October and employers can register here. The conference aims to provide employers with best practice examples and tools to take back to their workplace.

To book a free online demo of Bright Contracts click here

To download your free trial of Bright Contracts click here

233 employers to pay back £2 million to underpaid workers

233 employers have been ordered to pay back almost £2 million to 13,000 of the UK’s lowest paid workers, as part of the Government’s scheme to name and shame employers who fail to pay the National Minimum Wage and Living Wage.

A list that identifies these employers has been published by The Department for Business, Energy and Industrial Strategy. As well as paying back the money owed, employers on the list have also been fined £1.9 million by the Government.

The sectors that featured frequently on the list included:

• Hair and Beauty: approximately 60 employers, in arrears of £121,000 for circa 200 workers

• Hospitality: approximately 50 employers, in arrears of £77,000 for circa 220 workers

• Retail: approximately 20 employers, in arrears of £1.5m for circa 12,200 workers

Employers in this round fell short by failing to pay workers overtime hours, deducting money from wages to pay for uniforms and wrongfully paying apprentice rates to workers.

Business Minister Margot James said:

“It is against the law to pay workers less than legal minimum wage rates, short-changing ordinary working people and undercutting honest employers. Today’s naming round identifies a record £2 million of back pay for workers and sends the clear message to employers that the government will come down hard on those who break the law.”

This is the 12th round of Government naming and shaming with so far £6 million recovered for 40,000 workers with 1,200 employers being fined £4 million. Employers need to be aware of the National Minimum and National Wage and Apprentice rates. Employers who fail to comply with these rates could face substantial fines and risk their business being named and shamed. To view the current rates click here.

To view the full list click here.